Real estate financing

We understand that the path to profitable property projects requires special financial considerations. Regardless of the reason for your financing, we can provide you with comprehensive advice to help you find the best (re)financing option to suit your needs based on the numerous financing instruments available:

We also support you in raising debt capital for the first time and establishing appropriate relationships with lenders.

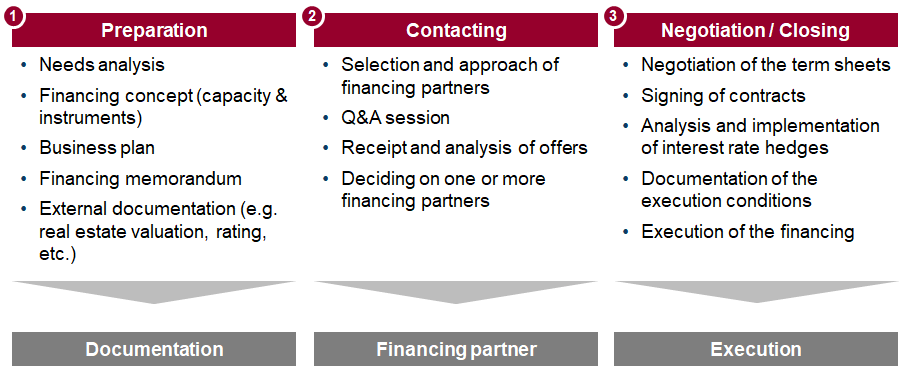

A financing process comprehensively accompanied by us usually includes the following procedure:

Whether you are looking for optimal debt capital structures, flexible repayment options or tax-optimised financing models, we will advise you comprehensively on the possibilities with our partner network. In recent years, we have structured and implemented numerous attractive and creative property financing solutions for Swiss property companies, both off-market and via the capital markets. With our broad network of lenders and innovative structuring approaches, we have been able to realise customised financing solutions at attractive conditions for our clients.

As an independent advisor, we position ourselves at your side and support you throughout the entire financing process.

You also benefit from the following added value:

- Financing security: Higher chances of success when taking out a loan, often with a higher loan amount.

- Cost savings: Better conditions (interest costs, fees, etc.) as well as significant relief for management.

- Increased flexibility: Reduction in the number and materiality of conditions and reduction in the necessary collateral (pledges, guarantees, etc.).

- Minimisation of interest rate risk: Diverse implementation of interest rate hedging strategies.

Can we help you with your property financing plans or would you like to explore your options with us? We look forward to hearing from you.